There are various DEX’s built on the BitShares blockchain and lots of arbitrage bots that automatically take any opportunities that become available. These opportunities may arise by moving through various pairings in ways such as triangle arbitrage or they may arise by price differences on different exchanges. It’s the latter that I will speak about today.

First, a list of well known DEX’s built on the BitShares blockchain:

CryptoBridge

OpenLedger

GDEX

RUDEX

EasyDEX

You can trade Bitcoin on any of these exchanges and the price is constantly changing on all of them. This provides many opportunities for the arbitrage bots to profit… but how do they do that? First I will explain what actually happens when you use a decentralised exchange.

When you create an account on any of the exchanges listed above you’re actually creating a wallet on the BitShares blockchain. The various exchanges all use BitShares for their back-ends, it’s only really the user interface that changes and once you’ve created your wallet, you can log into any of them with it. On BitShares you can create tokens and trade any token for any other token. This is what the exchanges utilize.

So, once you have deposited your coins (Bitcoin in this example) you will be credited with a token created by the exchange which you are then able to trade for any other token on the BitShares blockchain. The tokens you will be credited with after you deposit Bitcoin at the above listed exchanges are as follows:

Bridge.BTC

Open.BTC

Gdex.BTC

Rudex.BTC

Easydex.BTC

These tokens look ugly with the prefix and when you use one of the exchanges interfaces they tend to remove it to just show “BTC”. Some exchanges also block you from seeing their competitors tokens so you can only trade their own tokens from their interface.

If you use the BitShares reference wallet (bitshares.org) you see every token created on the blockchain, including prefixes and can trade any pair you can think of regardless of who created it. This opens up a whole lot of AE markets many of you have never even considered. For Bitcoin they are as follows:

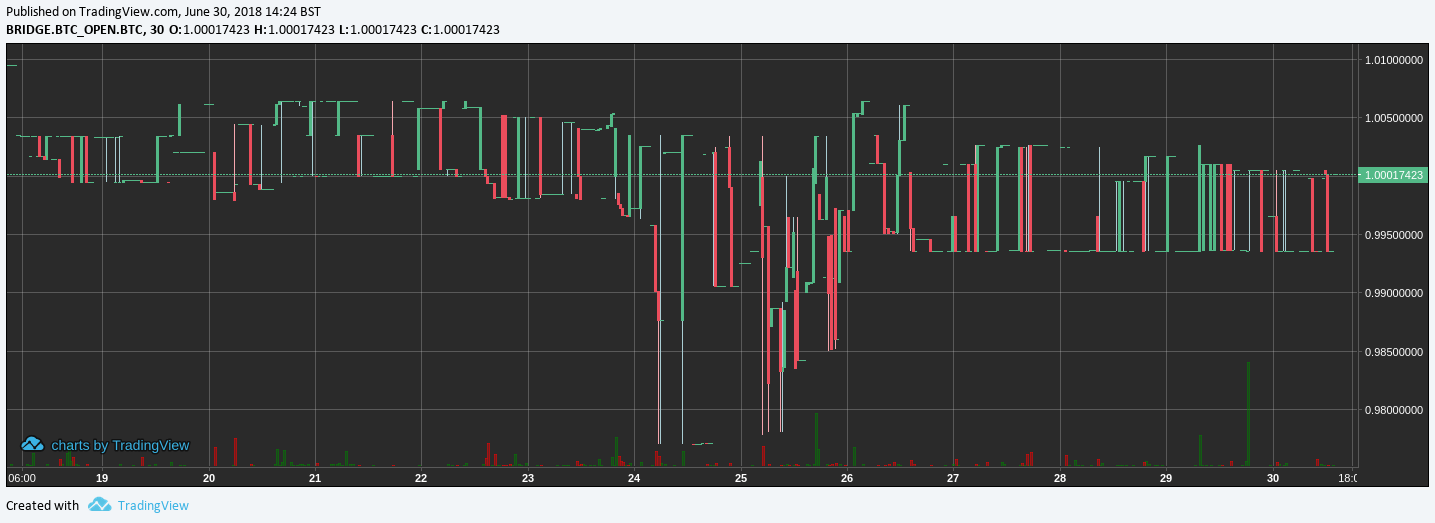

Bridge.BTC-Open.BTC

Bridge.BTC-Gdex.BTC

Bridge.BTC-Rudex.BTC

Bridge.BTC-Easydex.BTC

Open.BTC-Gdex.BTC

Open.BTC-Rudex.BTC

Open.BTC-Easydex.BTC

Gdex.BTC-Rudex.BTC

Gdex.BTC-Easydex.BTC

Rudex.BTC- Easydex.BTC

Either side of the order book is a token that represents the same asset (BTC). If each token represents the same asset in an ideal world the cost would always equal “1”. Arbitrage bots use these markets to switch exchange. For example: They could buy Bridge.BTC for $5k, swap it for Easydex.BTC and then sell that for $6k. Depending on price differences and whether there are orders to take on the AE markets.

By placing orders on the AE markets for say 0.99 on one side and 1.01 on the other. You allow the bots to move easily between exchanges and take the opportunities. These markets are unlike other markets… You don’t need to wait for a buy AND sell order to fill to make a profit. As soon as a single order has filled, you have 1% more Bitcoin, only difference is your now holding a different exchanges token which is redeemable for Bitcoin.

So now that I’ve explained the basics I’ll tell you a few tips and tricks…

Sometimes you may find that the majority of orders get filled on one side of the book and you quickly end up with all your assets on the side with no action. Don’t wait… withdraw your coins from one exchange to the deposit address for the other exchange and you’ll soon be back in business. I use to withdraw Litecoin direct from CryptoBridge into my Openledger deposit address multiple times a week. I would say on average it took 20 minutes to arrive. If your using small amounts this might not be cost affective, you’ll need to check fees etc.

If the market your working is dead it may be tempting to set orders at 0.9 & 1.1 giving you a 10% profit when filled. This may happen but its unlikely. Remember that the profit you make is your cut of the arbitrage bots trade. Your the market maker making their trade possible. If theres only a 2% profit opportunity for the bot your cut will have to be smaller. On the flip side, you don’t want your cut to be needlessly too small.

Competition. Your not the only one reading this article! One week you might be making good money… The next someone comes in and starts placing orders above yours and stealing all the action. Battle it out and see who survives! At the end of the day a 0.1% profit is still better than just “hodling” your coins. Ever seen those annoying bots that place an order 1 satoshi higher than yours? Updating every time you change your orders? We all hate those bots… unfortunately your quite likely to bump into them in these markets. Theres two ways I’ve found of dealing with them. Set a high order forcing them to get filled with very little profit. A lot of the time when you do this they have to wait to get filled on the other side to return. Then lower your asking price again. Ive noticed they seem to have a max price set. Find that price and set orders close to one. You will be making small profits but you’ll be getting most the action.

Making these markets is easy. You can set orders and just check once everyday or so or you can use DEXBot. Use the relative orders tool, set a centre price of 1 and a spread of say 2%. This will place orders at 0.99 & 1.01. Relative orders waits for an order to be filled before resetting so you may want to have a think about your order size. Alternatively, in the earlier versions of DEXBot orders were reset as soon as an order was partially filled, which is probably better for this use case. You could set order size to 100% relative order size. This would mean 100% of your assets were on the books and as soon as some were filled it would replace it on the other side.

What I’ve mentioned in this article is just the Bitcoin markets, there’s many more. Litecoin, Ethereum, Steem, EOS and don’t forget that both CryptoBridge and Openledger will soon be listing erc20 coins creating many, many more AE markets and opportunities. If your a “hodler” don’t just “hodl” put your coins to work and increase your position size. I turned 10LTC into 14LTC in 6 weeks using the Open.LTC-Bridge.LTC market. Have a go and see how much better off you are making these markets than just “hodling”.

Below are links to the DEXBot room and Market Makers community room should you want to learn more about this strategy and get involved with market making.

Bitcoin user, BitShares community member, market maker and DEXbot team player. Working to improve liquidity on the DEX. I do not offer financial advice.